Dr. StrangeFed or: How I Learned to Stop Worrying and (Sorta) Love Inflation

One part COVID recovery, two parts Brandon... and three parts a failed Clinton-Obama-Biden foreign policy culminating in Ukraine.

There are three things driving inflation right now:

The US economy is eating two years of both growth and inflation in an effort to reclaim the COVID-19 shutdown with pure Keynesian debt spending.

Building upon President Donald Trump’s decision to pursue (1) and mindful of how Obama was effectively handcuffed in 2009 due to the Great Recession, President Joe Biden’s economic policy team deliberately chose upon a policy that would flush the US economy with even more cheap cash in an effort to enshrine his own policy agenda.

President Joe Biden decided to support the 2014 Maidan revolution in the Ukraine with moral support and economic sanctions, thus driving the Russian Federation into the arms of the Communist Chinese and putting tremendous pressure on energy and food markets in both the West and the developing world in order to force Russian war aims and bring the conflict to a speedier end.

That’s it.

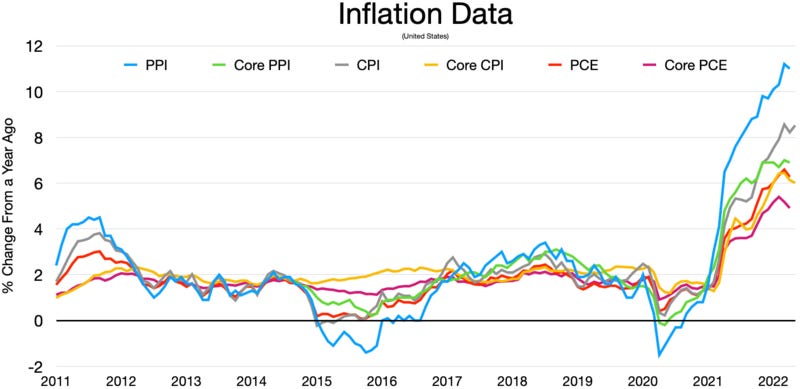

Just in case you can’t read the very fine print here, the green line here is the percentage increase of money in the US economy year-to-year (YTY) — the M2 money supply. The Core PCE (personal consumption expenditures) is how much you are spending on stuff. Probably no surprise that if you give people a $300 stimulus check they are going to spend it or save it.

Combine these two and you’re going to get more money chasing fewer products, which results in inflationary pressures. The same $1.00 widget becomes $1.10 — but not uniformly across the board, mind you. In some things, we manage to produce more; in others, there is simply less of it to chase.

Like oil.

The catch here of course is that the PCE and the Core PCE are mirroring one another, which means that the inflationary pressures are not first-order repercussions of an energy shortage.

Yet the second order effects on the US economy (and global economy) of the Russian-Ukrainian conflict on food, fertilizers, timber and other resources consumed by the developing world means that there is a trickle-down effect that is most noticeable in natural gas, oil, and gasoline and secondarily noticeable in areas of the economy that rely upon cheap energy — agriculture being first among them.

Your blue hockey stick — and it is always a hockey stick, isn’t it? — is inflation including things such as energy and food. That is to say, the number that tells you how much it costs to produce a thing, also known as a producer price index (PPI).

The CPI — consumer price index — is the weighted average from the perspective of consumer spending.

The PCE — personal consumption expenditures — mirrors your first graph up top relative to the money supply (M2). Anything that is a Core PPI, CPI or PCE removes the increased cost of energy and food by and large, or the things most susceptible to inflationary pressures.

So that’s four data points with an alternating focus based on whether or not you want to see all the inflations! or the inflation that matters to a kitchen table budget.

Of course, the good news is that the Federal Reserve has been working overtime to decrease the amount of M2 in circulation. Which should help stave off inflationary pressures in the long run. The fundamentals of the economy are also relatively strong in the United States — demand is up, real unemployment is at 6.7%, and thank you Steve Mnuchin.

The bad news? Between the Russians and the Chinese governments and the developing world, the threat of food shortages and expensive energy is exposing many countries to stagflationary pressures — high inflation, slow growth, high unemployment.

Let’s make this just a tad more difficult, shall we?

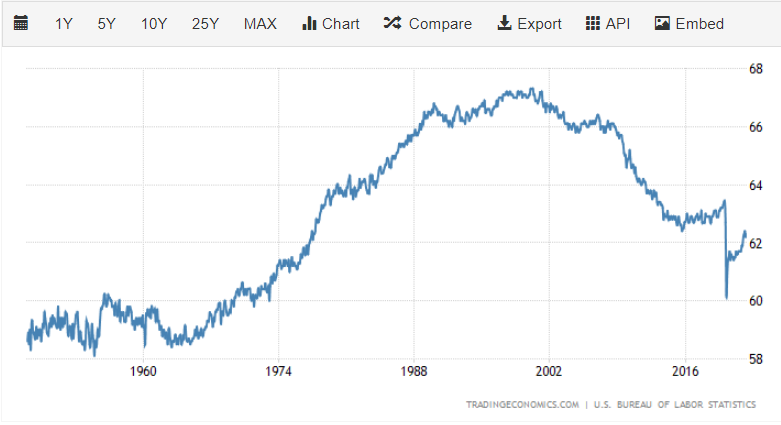

According to the US Department of Labor, our Labor Force Participation Rate hasn’t even come close to recovering from the 63.5% rate before the pandemic — instead hovering at a mere 62.3%.

Which raises a question that transcends political parties, because it doesn’t matter if your unemployment rate is at a hypothetical 6.5% of the labor pool when nearly 40% of your citizens can’t find meaningful work:

Geopolitical Realities Abroad; Fiscal Realities Back Home

So why is Russia such a big part of this conversation?

While a solid half of this inflationary period can be blamed upon the Biden administration’s basic ineptitude concerning domestic policy, the other half is directly attributable to Biden’s basic ineptitude on foreign policy — specifically by doubling down on Clinton-Obama era post-Cold War objectives in the Ukraine.

Now if that seems like a stretch to link the two, allow Joe Biden to do the linking. One 10 June, Joe Biden gave a talk in Los Angeles blaming 8.6% inflation on the Russians, calling inflation a “Putin tax on food and gas” that doesn’t seem entirely digestible at first glance — not when you contrast CPI vs. Core CPI.

Yet it does point to a certain fallacy that US and EU policy makers have attempted to prop up over the last eight years despite clear warnings from the Russians — namely that prying the former Soviet republic out of the Russian sphere of influence by sacking their democratically elected if pro-Russian president in a “democratic uprising” was not going to be tolerated by Moscow.

Very recently, former Secretary of State Henry Kissinger advised a group of Western diplomats and business leaders that the West needed to find an off-ramp from the Russian-Ukrainian conflict as quickly as possible:

"Parties should be brought to peace talks within the next two months. Ukraine should've been a bridge between Europe and Russia, but now, as the relationships are reshaped, we may enter a space where the dividing line is redrawn and Russia is entirely isolated. We are facing a situation now where Russia could alienate itself completely from Europe and seek a permanent alliance elsewhere. This may lead to Cold War-like diplomatic distances, which will set us back decades. We should strive for long-term peace."

Kissinger being the dean of the realist school on US foreign policy huddled around influential publications such as National Interest, one would assume that the idealists would take pause. After all, much of our foreign policy has been divided between realists who understand that the Pax Americana shared more of the shelf life of the Pax Brittanica rather than the Pax Romana, and the idealists of the liberal internationalist school who in their neo-conservative and neo-liberal manifestations seek to broaden and if needs be impose their values so as to spread the influence of the West and maintain peace.

The problem with the idealist position is that where printable American dollars fail, we inevitably resort to the application of precious metals. After all, the full faith and credit of the United States isn’t backed by the precious metals of gold and silver, but by copper and lead. The litany of horribles is perhaps too long to account for: Iraq, Afghanistan, Syria, Yemen, Libya, Somalia and now Ukraine — just to name a few.

Yet the United States has other, more economically oriented weapons at our disposal.

Pick the top three American generals since the post-WWII era. The correct answers? General Dynamics, General Motors, and General Electric. The irresistible power of the United States economy as the hub of Western economic activity has been a fact since the end of the Second World War. The threat of sanctions — of being excluded from this family — as a weapon of asymmetric warfare is a rather new tool, but a rarely effective one and nearly always a double-edged blade.

Of course, Russia still needs to sell its vast energy reserves to someone in order to prop open their economy — what former US Senator John McCain famously referred to as a gas station with a government — which requires markets in Europe who continue to skirt sanctions through various loopholes. China and India remain consumers of cheap Russian energy despite US sanctions.

In short, the world is addicted to cheap hydrocarbons and Russia is the dealer of choice. The billions of dollars being thrown at Ukraine aren’t showing much impact on the ground, with the Ukrainian Armed Forces bleeding out a battalion a day and 19 million civilians displaced. The current US State Department strategy of making Ukraine “indigestible” and prohibitively expensive is coming at the reality of turning Ukraine into another Syria — a war the Russians know how to fight and win.

Meanwhile, the cost is being carried both by Ukrainian civilians and Western consumers.

If US-EU projections are right that the conflict should be dragged out for 5-10 years, if the Russian government is prepared to bleed to recapture Kiev in a way no NATO country will, and if the EU’s resolve — particularly France and Germany — is wavering in order to find a solution that stops the bleeding, then isn’t the better long-term play to mediate an outcome and focus on what a post-Putin Russian Federation will look like in 20 years rather than prolong human suffering, both in theater and worldwide?

Unfortunately for the American consumer, lowering gasoline prices and food prices by re-inserting Russia into the global economy is not going to happen overnight.

First and foremost, the Russians know that Europe cannot survive without Russian energy — full stop. Russian energy will always have a customer.

Second, they know that any additional easing on European energy concerns only alleviates political pressures on President Biden, whose party will shoulder the blame for the recession during the 2022 mid-terms and possibly again in 2024 should former President Donald Trump run.

Third, the Russian Federation knows that they hold a great deal of leverage when it comes to feeding places such as Turkey, Egypt, Syria, et al. With Ukrainian grain exports stopped and Russian grain exports at a premium, increased food prices will create increased instability. As Western resolve wanes, Russian soft power will increase until calls for a mediated settlement become audible and finally irresistible — and more concerningly, from BRIC countries rather than NATO countries.

All the more reason why Kissinger is signaling two things: (1) explicitly that the better long-term play is to mediate a settlement that preserves Ukrainian territorial integrity, and (2) implicitly that the Obama-Biden policy of excising Ukraine from the Russian sphere of influence on the cheap was and is a categorical and catastrophic multi-trillion-dollar mistake in which Ukrainian civilians are paying for dearly in both blood and treasure.

Now the US and EU do have one ace to play that resets the board entirely.

That is the application of NATO power. A swift deployment of troops to Kiev under any pretense, followed up by any argument you’d prefer — a cease fire declaration with NATO observers along a front — followed up by NATO troops staging in Poland and deploying into places such as Odessa, Lvov, Nikolaev, and Kharkov.

The Russians have already threatened that this would invite a nuclear response, which is the traditional Russian response to any threat — overwhelming force.

But are American families — thus far unwilling to pay $5.00/gal for gasoline or $3.00 for a loaf of bread — going to purchase the liberation of Ukraine with the lives of their sons and daughters? To what possible or impossible end? Regime change in Russia as suggested by former US Ambassador to Russia Michael McFaul? Even to the point of a limited and tactical exchange of nuclear weapons?

Inflation may be a tax on the poor, but much like sanctions it is also a weapon of war when leveraged by foreign actors. Yet two sides can play at this game, and so long as the Russian Federation believes that it can shoulder the impact better than the United States and European Union — even with a cessation of hostilities in Ukraine there is no immediate promise of a return to any status quo ante bellum.

Biden may choose to believe it is a “Putin tax” for the purposes of rhetoric, but the fact of the matter is that the United States created these conditions in order to neutralize Russia as a great power — and Russia reacted with kinetic force rather than meekly acquiescing to the logic of game theory over at RAND or ISW.

Unlike game theory, the consequences are very much real. Talk to anyone even remotely connected with Caritas International or Catholic Relief Services; 44 million Ukrainians and 20 million Syrians have paid or are actively paying the price. Poland graciously carries the vast majority of the refugee burden.

Yet as food prices rise in the developing world and energy prices continue to climb, as civilian and military casualty rates continue to climb, as the Biden administration is prepared to bleed Russia to the last Ukrainian, are the failed policies of liberal internationalists and neoconservative leftists really worth the bill?

I’m not so sure.

Nor am I willing to be bullied into thinking as such so that someone else can make a buck off of either the racket of war or the suffering of Ukrainian civilians. Zelenskii is no Winston Churchill; he’s a Charlie Chaplin warning about what happens when you pursue war aims on the cheap:

Either we back up our word with NATO power or we acquiesce to geopolitical realities and focus on what a post-Putin Russia — and ideally one friendly to the West and not driven into the arms of the Communist Chinese — ought to look like.

Everything else is justification of the morally impossible.

One really doesn’t have to be Nostradamus to figure out why the Biden administration is so heavily invested in Ukraine. Or why they have turned Ukraine into a social justice movement and any nuance is treated as some sort of Manichean either-or with good guys here and evil people to be destroyed over there.

The cost for that sort of thinking is measured out in lives and livelihoods. But you’ll note one thing — they are rarely if ever asked to carry the consequences.

In short, the inflationary pressures are going to be sharp, real, and hopefully of short duration as the M2 rate continues to come down.

Meanwhile in the developing world, the food shortages are already a stark reality with an estimated 50 million facing famine. Yet the first and second order economic consequences of trying to pull Ukraine into the European Union will continue to have deleterious effects on the global economy — which will continue to pinch Americans at the gas pump and the supermarket for the foreseeable future.

Shaun Kenney is the editor of The Republican Standard, former chairman of the Board of Supervisors for Fluvanna County, and a former executive director of the Republican Party of Virginia.