How Much Has Inflation Really Gone Up Since 2021?

50% for food, 25% for energy -- and it was all planned. How much longer should we tolerate it?

Great news, товарищ! Inflation only rose 3.0%! Gas prices fell to a modest $3.69/gal! Celebrate Comrade Biden’s Glorious Four-Year Plan!

Of course, if you’re not buying it? It’s probably because you can’t afford to…

Here are a few helpful charts to put that pain into perspective. Whether it is energy prices — gasoline, electric, other — or food prices, Americans aren’t just hurting, they are being wrung out as a matter of policy in an effort to avoid a recession.

Biden’s policy wonks might cheer their efforts, but the fact of the matter is that inflation is and remains a hidden tax on the working class, one that is making the middle class poorer while safely protecting those with excess means — and specifically the state and federal government.

News Flash to Policy Wonks: People Are Hurting Out There

Something to consider: what we are witnessing is the undoing of the Republican-era federal tax policies enacted by the Trump administration in 2017. Whether by design or in reaction to the Russian-Ukrainian conflict, it is one of the largest wealth transfers in the history of the United States — and it is going to those who already have it at the expense of those who never did.

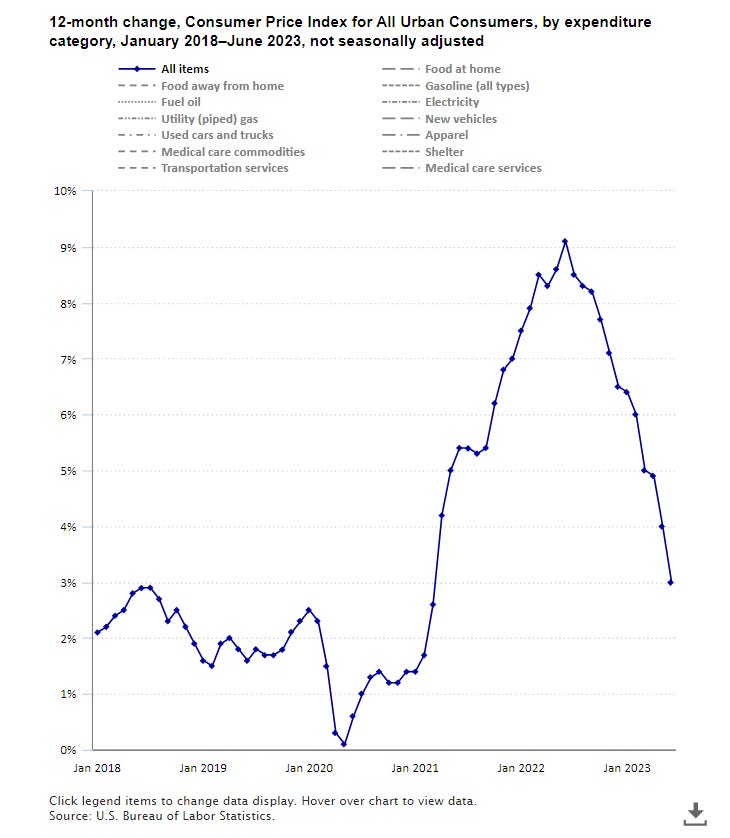

Here are the numbers from the US Bureau of Labor Statistics. You can click on the little bylines (i.e. “Food away from home”) on the website and it will toggle what the CPI is for that particular item. Some things have calmed down in terms of continuing inflation; none of these items have reverted to their pre-Biden era price tags.

Yet the tricky thing here is twofold:

To say that inflation has “calmed down” doesn’t lower prices one iota. In fact, the average everyday cost for things continues to rise — and more notably, outpace real GDP growth in the United States.

The YTY (year to year) inflation rate isn’t being presented visually, meaning that the American consumer is actually fighting back-to-back double-digit percentage increases in the cost of everyday things.

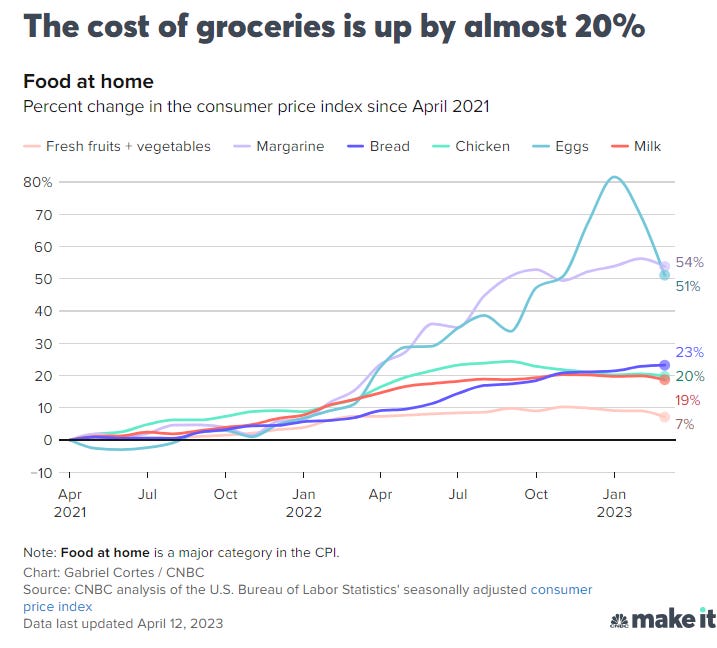

So how much has the price of stuff actually gone up? These numbers from CNBC help visually show how the cost of Bidenomics has impacted the American consumer in a big way:

Two numbers to consider: (1) inflation which includes everything and (2) core inflation which excludes the more volatile products such as energy.

Either way, 13% is a number we can play games with, because the actual impact on everyday items is far larger:

Remember when egg prices doubled? They have calmed down somewhat, but not to any degree worth mentioning. With inflation closer to 22%, the cost of everyday grocery items such as butter, milk, chicken and bread has kept on-par with the actual numbers.

This one is a bit trickier, for two reasons: (1) most cars are moving to electric in order to meet California’s state mandates, and (2) your average vehicle has more gizmos and electronic devices than your average teenager.

Is the cost of new cars really inflation? Or are car manufacturers taking advantage of the times and installing the equivalent of iPads in order to make that $30,000 purchase closer to $36,000?

No small wonder why the used car market continues to be red hot and earn top dollar for purchasers hurting on every other front. No small wonder as well why automobile repairs continue to climb as working class Americans fix and repair rather than buy off the lot.

Airfare and hotels? Way up — with airlines struggling to pass on the cost of jet fuel in the wake of the Ukrainian crisis and hotels simply hoovering in cash because screw you guys they can.

One thing to note? The cost of electronics is down, indicating a post-pandemic surplus of gear rather than any innovations in the market.

Still — where the tourism industry can get you, they will. Nothing has calmed down in the post-COVID era as families chose to get out and go outside rather than coop themselves inside and get sick. Probably not a bad thing…

Now for the piece de resistance:

Want to stay home and save money? Nope — government is gonna squeeze your paycheck there, too.

Energy costs are the number one driver, yet appliances, furniture, tools and hardware in the DIY space (where everyone stayed home and improved their lot) have all gone up. Even Netflix and Spotify are charging you more for the same service.

Why Biden Chose Inflation Over Recession

Of course, the pandemic did not cause this tidal wave of inflation any more than Trump’s policies did during the crisis. What caused this inflationary pressure?

A choice.

What the Biden administration chose was a very long and broad inflationary policy in order to dodge what should have been a sharp but short recession, one caused not by the pandemic or the Trump-era fiscal policies which pushed a great deal of money into the middle class, but rather by the Biden administration’s course correction which pushed trillions more into an American economy already saturated with cash during the pandemic.

The Federal Reserve wanted their money back, is all. And though GDP growth in America has gone up 2.7% and an estimated 3.5% over the last two years, it’s awfully tough to fight back-to-back 10% inflation. From the Washington Examiner:

“People feel and see what they see. No matter what spin comes out of the podium there at the press room or out of Biden’s mouth, they see the difference,” Ortiz told the Washington Examiner.

For instance, in January 2021, a gallon of gasoline averaged about $2.25, according to the Energy Information Administration. Now, a gallon of gas is about $3.60, an increase of 60% since Biden was sworn into office. Still, current prices are 28% lower than when the cost of gas peaked in June last year.

Another example: Boneless chicken breast was going for an average of $3.26 per pound when Biden began his term but has since risen more than 28%. Likewise, the index price of a used car, as tracked by CarGurus, was $22,807 in January 2021 but is now $29,542, representing an increase of nearly 30%.

Ortiz also pointed out that credit card debt is at record levels and record delinquencies. Savings levels are also extremely low, he said.

With less money to spend on more expensive stuff, Americans are making a choice for debt while unable to restrict their spending on daily needs.

That’s not a good sign for the American economy in the long run, as working class Americans feel poorer precisely because they are pooer.

So How Is The Economy Really Doing? NOT GOOD.

One of the real tests of economic strength? How willing are American taxpayers absorbing new long-term debt.

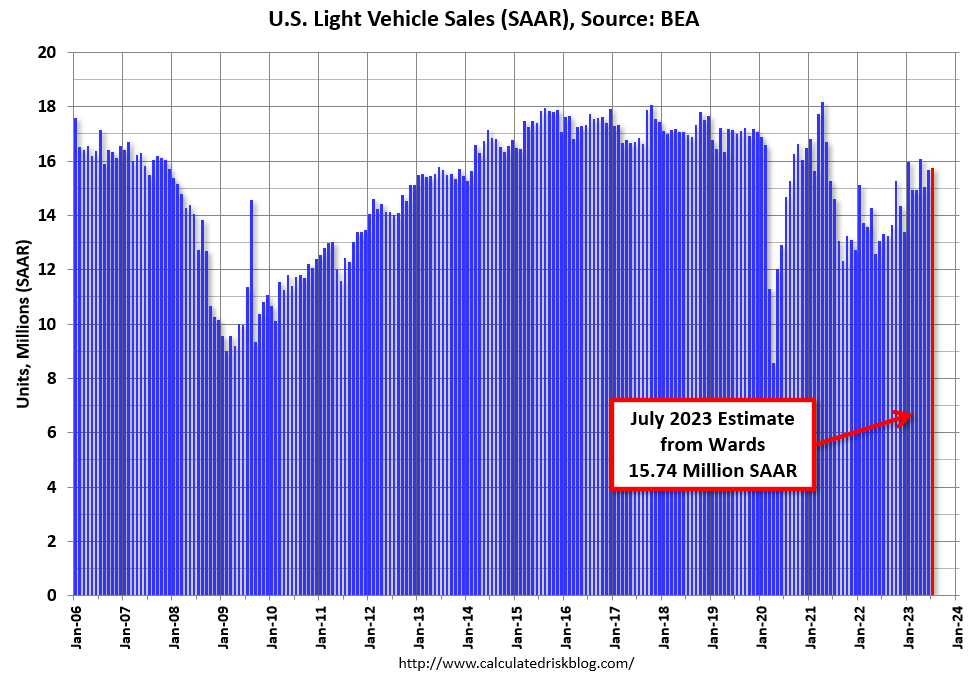

Here’s your chart of doom:

The trend during the Trump administration was robust but on that steady trendline heading south, with the automobile industry alternatively recovering from the Great Recession and being impacted by federal policies reducing automobile travel in favor of either mass transit or alternative transit (think bike lanes). You get a sharp dip and sharp recovery during COVID.

…and then Biden happens.

Now the good news is that new automobile sales are indeed recovering.

The bad news? Not nearly fast enough and not with every cylinder firing as it ought.

The most likely cause for this? Interest rates are sky-high, with mortgages at 7.10% as of this writing and auto loans about two points higher than that.

Something else to consider? There are plenty of jobs out there in the American economy, but no one wants to work meaningless jobs for meaningless pay:

Notice the trendline?

That’s right — the job growth is a Trump-era phenomenon interrupted by COVID and the Biden era. Notice too that the number of quits — while cooling, is still very hot when compared to the number of terminations, which continues to decrease (indicating that it is a worker’s market for sure).

What about US manufacturing, you say?

Total freefall during the Biden era after a recovery during the Trump administration.

Solutions? Republicans Have a Few…

At the state level, there really aren’t too many solutions when it comes to federally-driven inflationary pressures.

The Youngkin administration’s bid to ease pressures on large corporations in order to make Virginia more big-business friendly help bring higher wage jobs, but also bring the contaminant problem of attracting blue state workers who bring their values to red state engines of economy (see: Northern Virginia, People’s Republic of).

One question that could and ought to be raised? Would a short but sharp recession have been better to cull these surplus jobs no one wants to take in order to keep consumer prices 20% lower? Economically, this may have been wise. Politically for the Biden administration? Perhaps not — but the scapegoat of COVID may have mollified most Americans if Biden had chosen to be an American president rather than a Democratic one.

In the meantime, American consumers get to figure it out as we go along. With the 2024 elections coming around the corner and Virginia Democrats in particular on the firing line, the great question — “Are you better off than you were four years ago?” — remains a question where Democrats find themselves kicking the dirt and for good reason.

We aren’t better off by a mile — and they know it. More to the point, Americans know why and should judge Democrats harshly in November and beyond.

Shaun Kenney is the editor of The Republican Standard, former chairman of the Board of Supervisors for Fluvanna County, and a former executive director of the Republican Party of Virginia.

Good analysis, hope the voters understand it.