The Moral Hazard and Student Loan Debt

Forgiving debt is like sticking a band aid on something requiring a tourniquet.

“But how is . . . legal plunder to be identified? Quite simply.

“See if the law takes from some persons what belongs to them, and gives it to other persons to whom it does not belong. See if the law benefits one citizen at the expense of another by doing what the citizen himself cannot do without committing a crime.

“Then abolish this law without delay, for it is not only an evil itself, but also it is a fertile source for further evils because it invites reprisals.”

— Frederic Bastiat, The Law (1850)

Joe Biden’s approval ratings are at 42% according to the latest RCP data, which still puts him underwater a solid 12 points.

Yet for a man who just 12 months ago was riding tall in the saddle until his sudden and last-minute withdrawal from Afghanistan — a strategic blunder which now hobbles our response to both the Russian Federation and the Communist Chinese — 42% seems like a godsend compared to earlier approval ratings of 29%.

Of course, Biden’s disapproval ratings have gone from 57% to about 54%, meaning that the lift over the summer wasn’t among Republicans and independents discontented with the status quo, but rather among progressives and liberals who like Peter Pan to Tinkerbell are clapping to believe.

The Wall Street Journal’s podcast had an excellent overview of what Biden’s $700 billion handout on student loans means for students, the economy, the state of our colleges and universities, and what precedent it sets in other areas — credit card debt, mortgages, small business loans and other debt jubilees absolved by the hand of the federal executive.

So How Bad Is This Going To Be?

To answer the burning question here, what the Biden administration did not do was raise taxes. The three card monte played here is akin to issuing an IOU that will now never be collected — $10,000 for student loans and up to $20,000 in Pell grants.

The revenue from these student loans in the form of interest payments and repayments will not be seen by the federal government, but much like any tax cut, what would have gone to Washington will now be spent in the economy. Hence the reason why the Biden administration can firmly claim that the debt forgiveness (sic) program will not bite into federal coffers or raise taxes.

The problem with so-called debt forgiveness programs isn’t in the pure mathematics, but rather in the creation of another problem where one might have believed we would have learned our lesson in 2008 during the Great Recession.

It is the problem of moral hazard.

Moral hazard is an economic term used to describe a condition where an individual or business increases its exposure to risk — in this case, student debt — knowing that may not bear the consequences for such risks.

Consider an instance where you take out a credit card and rack it up to a point where you cannot pay it down, where the interest is 29.9% and where it is negatively impacting both your social score credit score and your ability to get ahead. Perhaps your parents may see this condition and in an act of benevolence assume or pay off the credit card, with a hard scolding never to do this again.

In most instances, the unfortunate reality is that such bailouts only create the conditions for future bailouts. That is moral hazard, because even though you as a parent or grandparent may want what is best for your child and grandchild, and even though in pure mathematics it probably makes sense for all concerned, if one person treats the safety net as a hammock then it ruins the prosperity of the rest.

One person bearing such a debt is an anomaly. Yet entire constituencies who carry such loads of eye-watering six figure debt for degrees that end in —ology are going to have a hard time paying that back in a STEM-H driven world.

Plunder vs. Work: Doing What Is Easy Rather Than What Is Right

If a sizeable enough constituency of credentialed individuals is created who believe they are owed a living? Instead of producing, they take — or in Bastiat’s observation in The Law, they plunder:

“It is impossible to introduce into society a greater change and a greater evil than this: the conversion of the law into an instrument of plunder.

. . .

“No society can exist unless the laws are respected to a certain degree. The safest way to make laws respected is to make them respectable. When law and morality contradict each other, the citizen has the cruel alternative of either losing his moral sense or losing his respect for the law. These two evils are of equal consequence, and it would be difficult for a person to choose between them.

“The nature of law is to maintain justice. This is so much the case that, in the minds of the people, law and justice are one and the same thing. There is in all of us a strong disposition to believe that anything lawful is also legitimate. This belief is so widespread that many persons have erroneously held that things are “just” because law makes them so. Thus, in order to make plunder appear just and sacred to many consciences, it is only necessary for the law to decree and sanction it. Slavery, restrictions, and monopoly find defenders not only among those who profit from them but also among those who suffer from them.

Once the laws legalize plunder, the gloves come off for Bastiat.

Those opposed to such legal plunder — at present, Republicans — have two choices, either to join in the plunder with a plunder of our own or to restore the impartiality and justice of the laws so as to make plunder more expensive than work. Once this door is opened, there becomes a separation of law from justice”

“What are the consequences of such a perversion? It would require volumes to describe them all. Thus we must content ourselves with pointing out the most striking.

“In the first place, it erases from everyone's conscience the distinction between justice and injustice.

“No society can exist unless the laws are respected to a certain degree. The safest way to make laws respected is to make them respectable. When law and morality contradict each other, the citizen has the cruel alternative of either losing his moral sense or losing his respect for the law. These two evils are of equal consequence, and it would be difficult for a person to choose between them.

Of course, this does go back to a recurring theme.

Digging The Hole: Bad Faith Arguments and Moral Hazard

During the COVID-19 economic shutdowns, a series of small business loans were issued with the condition that if an employer held on to their staff the loans would be forgiven.

Large banking firms who issued cheap debt to Americans in an effort to turn them into homeowners collapsed and were branded “too big to fail” while families and small businesses found themselves remarkably expendable by the banks.

Total credit card debt in the United States? $887 billion — with the average US household holding $14,000 in debt as of 2021 and the average American carrying $5,241 in credit debt alone.

Total student loan debt? $1,750 billion.

Total automotive loan debt? $1,380 billion.

Total household debt? $16,150 billion.

Why not just assume it all under the federal government? Heck — the federal debt has ballooned from $4.1 trillion in 1990 after having defeated the Soviet Union to an eyewatering $28.42 trillion in 2021. Plunder it all. Will it fix the problem?

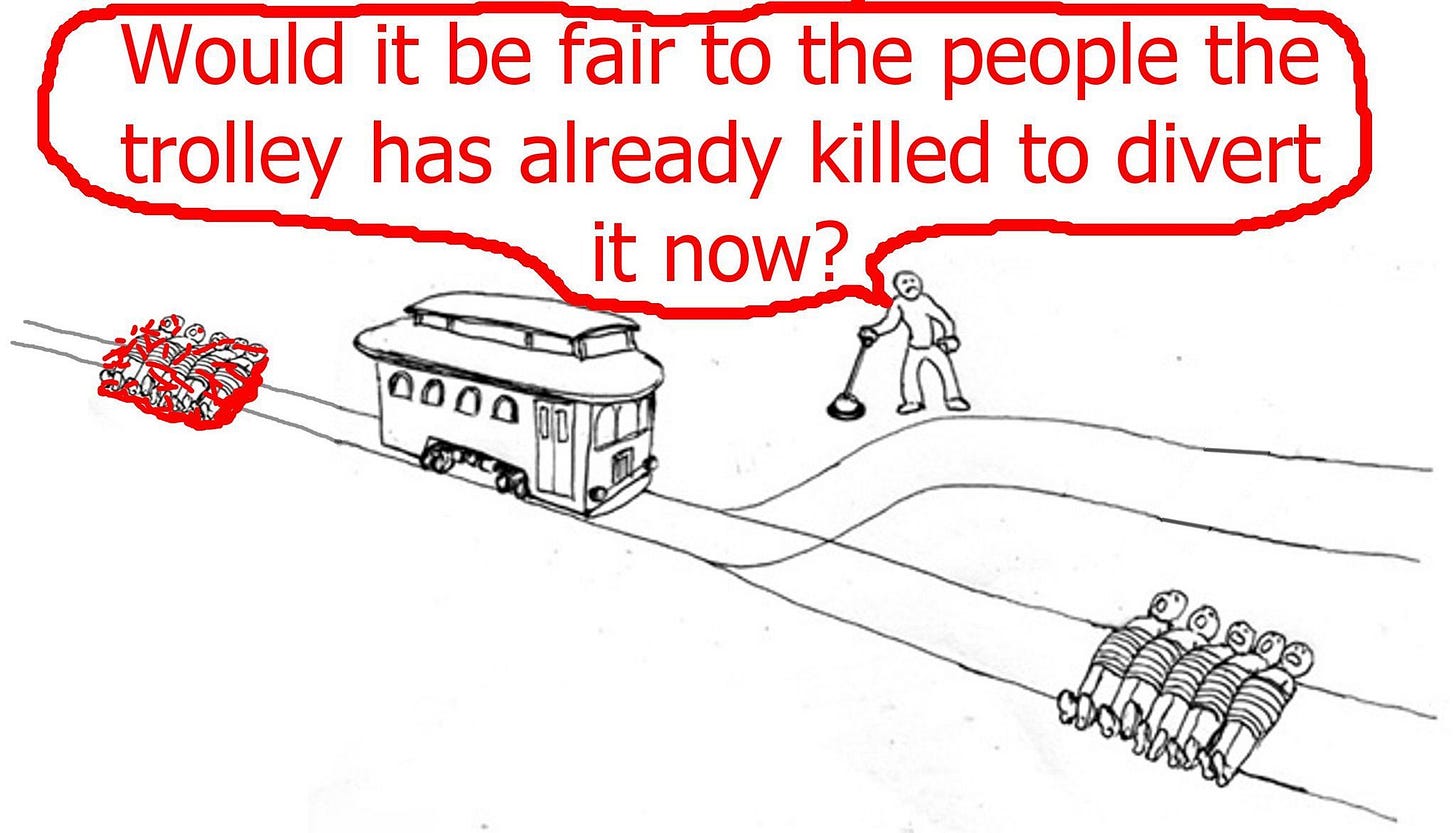

Then there’s puerile nonsense such as this, implying that those who worked hard to pay off their debt insisting that those who have debt do likewise is somehow cruel and unfair:

Small problem with that reasoning. This isn’t a matter of flipping the switch and the trolley diverts. This is a problem of flipping the switch and the trolley backs up to run those same people over. Again, moral hazard comes to the fore.

Which brings us to this disingenuous piece of work:

Folks will have to forgive me, but I fail to remember the story in Sacred Scripture where Christ, upon seeing the multitude who had taken out their loans, partied for four years, graduated from Pilate University and then upon discovering that their certifications did not qualify them to work in the Roman economy demanded they should be fed by those who were qualified, whereupon Christ forgave their loans and instructed the multitude, “Go forth and sin some more.”

Guess that’s why government isn’t God.

A Problem No One Wants To Fix?

Biden’s $700 billion debt forgiveness program may not hit our pocketbooks adversely, even though the liberation of all this cash will most certainly impact an American economy locked in stagflationary if not inflationary pressures.

Yet the precedent it sets where a constituency which has already shown a proclivity for violent temper tantrums during the BLM/Antifa riots of 2020 has been rewarded just a smidge. By smidge, I mean that even among leftist circles, the $10,000 debt forgiveness was termed as a “slap in the face” by one interviewee — deeming it wholly insufficient.

Of course, America’s colleges and universities — who have driven education costs through the roof over the last 20 years — have been particularly mum on the topic.

In Virginia, Republican governors such as George Allen and Jim Gilmore enacted tuition freezes that helped thousands of Virginia students plan and pay for their college educations. Youngkin is thus far negotiating such freezes on a voluntary basis, yet has stopped short of a full freeze (perhaps as a negotiation tool).

Either way, Virginia’s college and universities — some of whom remain flush with ill-gotten taxpayer dollars — do not seem terribly interested in arresting the tuition and board increases that make a college education worth a dime.

After all, they already have their money. Who inside the Ivory Tower wants to ruin a good thing?

Meanwhile, one does have to ask this question. How on earth does a blue collar employee look at a college-educated cubicle dweller and see two different systems of rewards and punishments?

If Democrats believe that working class Virginians aren’t going to deeply resent this handout to their progressive base, they have another thing coming to them in November.

I certainly would — and do.

Shaun Kenney is the editor of The Republican Standard, former chairman of the Board of Supervisors for Fluvanna County, and a former executive director of the Republican Party of Virginia.